Form 1040 Schedule 1 Download

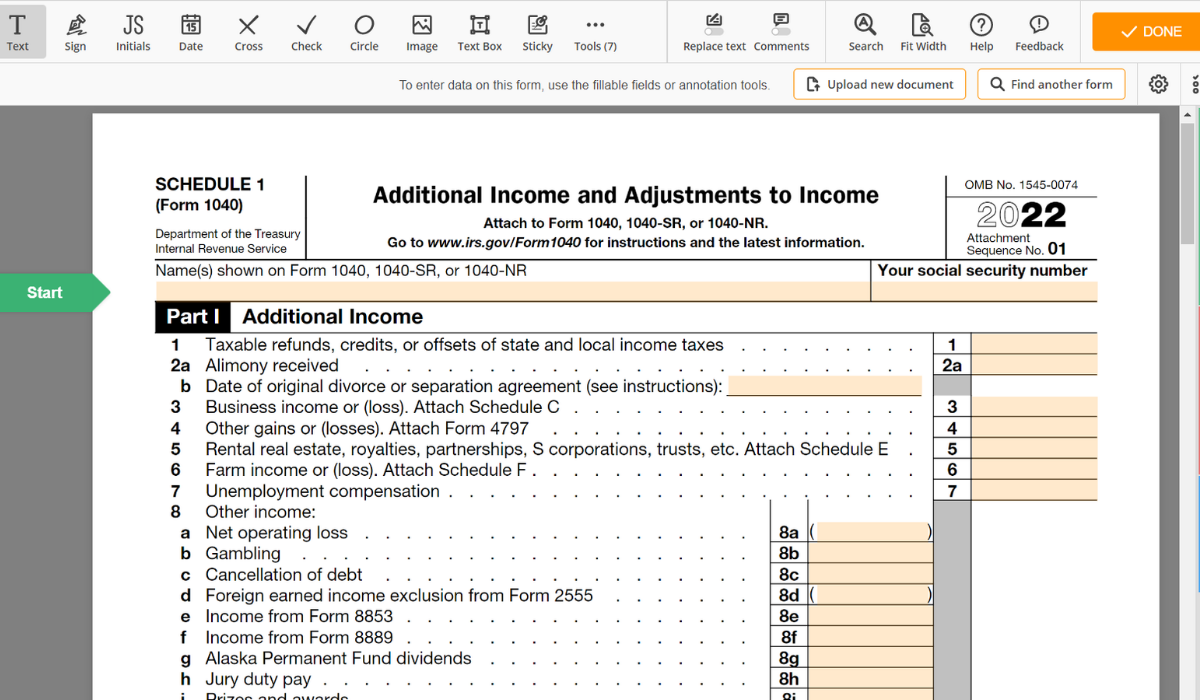

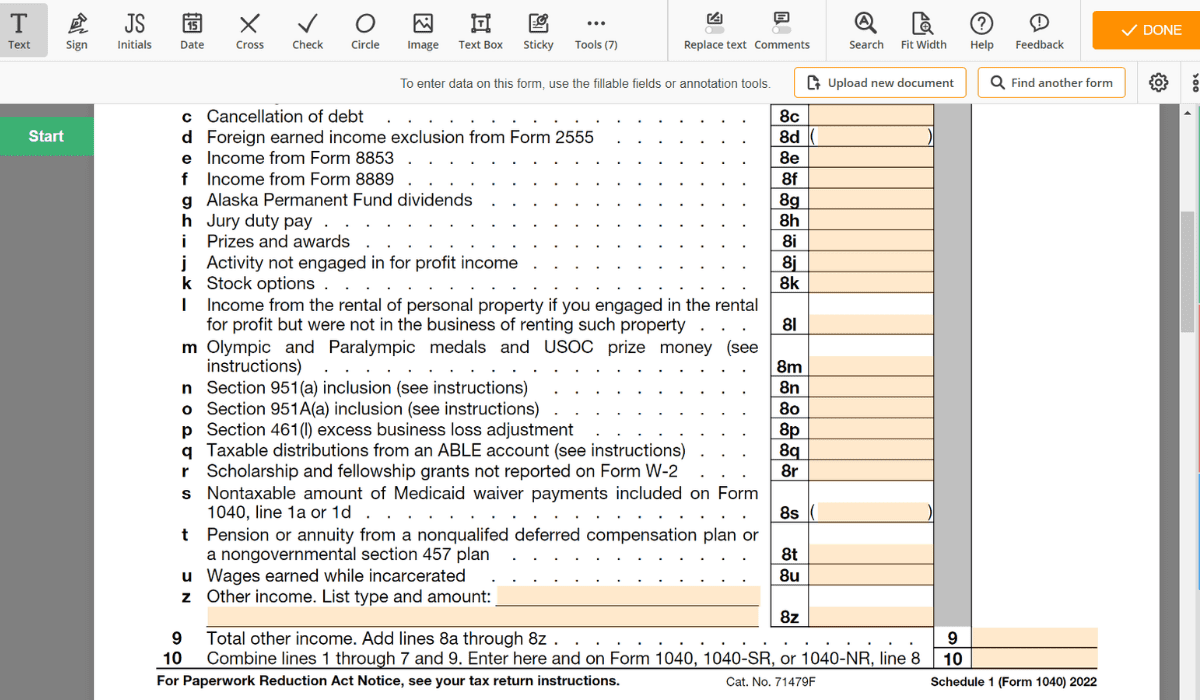

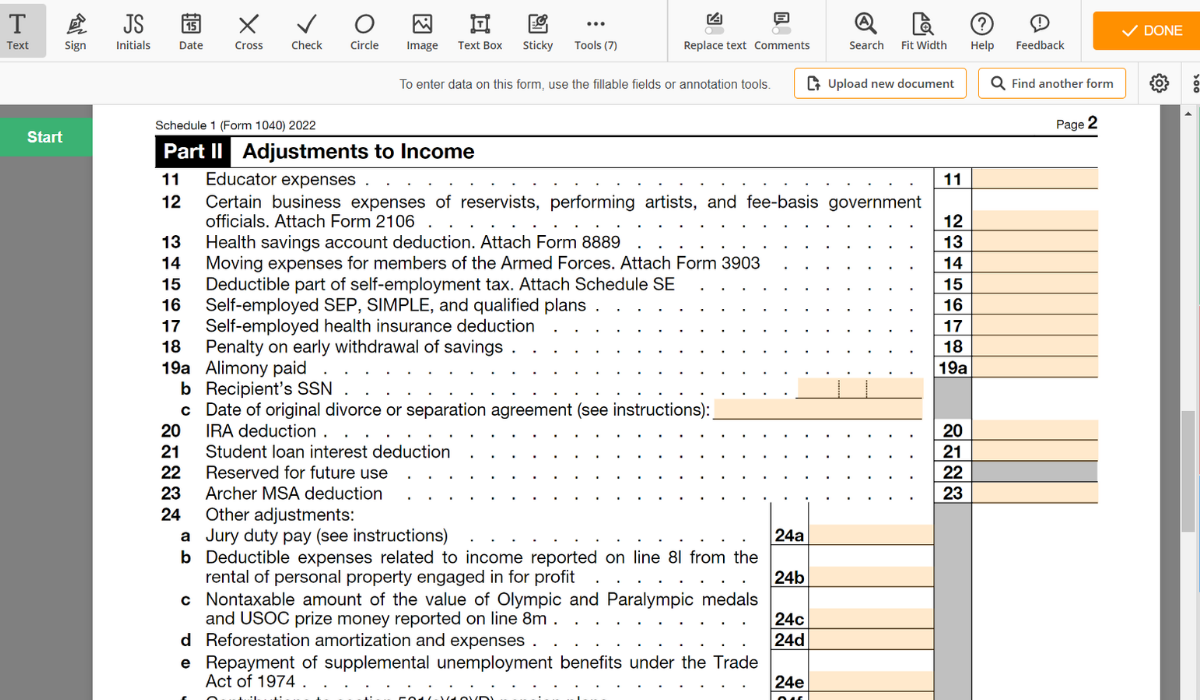

Filing your taxes can be a daunting task, but understanding the importance and requirements of specific forms can help make the process less stressful. One such document is the IRS Form 1040 Schedule 1 for 2022, which is essential for reporting additional income and adjustments to income. This vital form ensures that you provide accurate information to the IRS and could help reduce your tax liability.

2022 Form 1040 Schedule 1: Quick Guide for Taxpayers

To begin, you will need a 1040 Schedule 1 form printable, which can be obtained from our website or your tax preparation software. Once you have the relevant template, follow the Form 1040 Schedule 1 instructions to provide the requested information accurately. Completing the template involves reporting additional income sources such as alimony, rental income, or unemployment compensation. You will also need to report adjustments to income, such as educator expenses, deductible IRA contributions, or student loan interest. Make sure to fill out all the necessary lines and review the instructions carefully to avoid any common mistakes.

Fill Out Schedule 1 Form 1040 Printable Correctly

Speaking of common mistakes, it's crucial to be aware of the errors people often make when completing Federal Form 1040 Schedule 1. These include:

- Not reporting all additional income sources

- Miscalculating adjustments to income

- Omitting required information or providing incorrect information

- Failing to attach the completed Schedule 1 to your Form 1040

Ensuring that you avoid these pitfalls can help you prevent potential issues with the IRS and ensure that your tax return is processed smoothly.

Don't Miss the Deadline

Failing to submit a complete and accurate 2022 Schedule 1 Form 1040 can lead to significant penalties. If you don't file the copy or provide false information, you may face fines, interest, and even criminal charges in severe cases. The IRS takes tax compliance seriously, so it's crucial to ensure that you accurately complete and file your example on time.

Understanding the importance of Form 1040 Schedule 1 and following the instructions carefully can help you file your taxes without hassle. Be sure to avoid common mistakes, provide accurate information, and submit your document on time to prevent potential penalties. By taking these steps, you'll be well on your way to successfully filing your taxes and staying compliant with the IRS.